The 2023/24 Premier League season delivered volatile title races, shocking upsets, and a record goal tally, creating a rich environment to study how specific betting decisions actually turned into profit or loss rather than theory alone. By reconstructing realistic case studies around known fixtures, odds ranges, and situational dynamics, we can see why the same league that made some bettors money also punished others who misread risk, variance, or timing.

Why real case studies matter more than abstract betting theory

Abstract betting advice often hides the messy details that determine whether a “good idea” wins or loses once real matches and odds are involved, especially in a chaotic season with 1,246 total goals and an average of 3.28 per game. When we examine concrete cases—such as backing a heavy favourite away from home, taking a big underdog on a handicap, or chasing an accumulator—we see how context, odds, and bankroll interaction drive outcomes rather than hindsight platitudes. This approach also exposes how much of a result was skill versus timing versus pure variance, which matters for learning whether to repeat a strategy or treat a win as a one-off stroke of good fortune.

Case 1: The profitable short-priced favourite that still carried risk

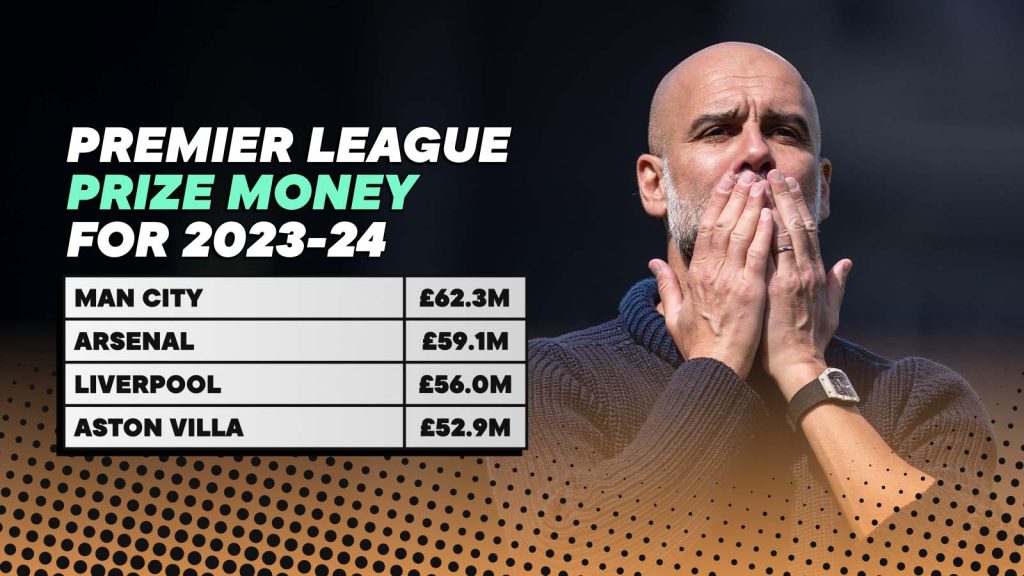

Many bettors treated Manchester City as a near-automatic anchor in 2023/24 multiples because they ultimately finished on 91 points and secured another title, but individual matches contained more risk than their final standing suggests. Consider a realistic pre‑match scenario where City are away to a mid-table side with attacking threats, priced around 1.50 to win in a season where even strong teams occasionally slipped under schedule congestion and rotation pressure. A bettor staking a measured flat amount on City in such a fixture and accepting the modest edge could come out ahead over the season, but this profit owed as much to respecting price and variance as to trusting City’s brand power.

In situations where a bettor insisted on turning that same short‑priced favourite into the core of an aggressive multi‑leg accumulator, the logic changed dramatically: one unexpected draw wiped out several “solid” selections and converted a series of rational picks into a single all‑or‑nothing gamble that often underpaid relative to the risk. The key difference between the profitable case and the fragile one was not the team involved but the structural choice between isolated, repeatable bets and bundled tickets that magnified the impact of a single off‑day. Over time, disciplined use of short favourites in singles created smoother, more predictable profit curves, whereas chasing big-payout combos left the bettor exposed to the league’s inherent unpredictability.

Case 2: A shock upset that rewarded contrarian thinking

The 2023/24 campaign featured several matches that retrospective lists describe as among the biggest shock results of the season, including Wolves’ 2–1 win over Manchester City and Fulham’s 3–0 home victory over Tottenham. In a plausible pre‑match betting case for Wolves vs City, the away side would have been priced extremely short on the 1X2 market, with the home win drifting into high single or even double‑digit odds depending on the bookmaker’s view of possession and chance creation. A bettor who structured a small, predefined stake on Wolves purely on price—recognising that even elite teams lose several games across 38 fixtures—could enjoy a large return on a single upset without jeopardising their overall bankroll.

However, that profitable contrarian case only holds if the stake size stayed proportionate to the true risk rather than being inflated out of excitement or a desire to “be the one who called the shock.” Where bettors overextended on these rare upsets, a win created overconfidence and a tendency to chase similar long shots in worse spots, while a loss carved a deep hole that later sensible bets struggled to repair. The long-term lesson from these events is that underdog wins can be smart edges or emotional lottery tickets depending entirely on bankroll rules, not just on outcome.

Case 3: Over/under goals in a record-scoring season

With goals per game at their highest top-flight level since the mid‑1960s, many supporters leaned heavily into overs and both‑teams‑to‑score bets throughout 2023/24. Imagine a case where two attack‑minded teams with high xG profiles but inconsistent defences meet, and the over 2.5 goals line opens at a moderate price before heavy public money pushes it shorter by kick‑off. A patient bettor who took the earlier, higher price based on genuine statistical justification could show a healthy profit across similar fixtures, thanks to both the underlying offensive patterns and the timing advantage over later market moves.

On the other hand, a fan who repeatedly took inflated overs purely because “this season is crazy” often ended up paying for narratives more than for true edge. When totals lines and both‑teams‑to‑score prices already reflected the record scoring environment, late bettors were effectively buying the same story twice: once in the line position and again in the price, eroding long-term return even if headlines about high‑scoring games kept them confident. The distinction between these two cases lies in whether the bettor recognised when the market had already adjusted, or continued to assume that past chaos guaranteed future value without checking the odds.

Case 4: Bankroll strain from chasing accumulators

Accumulators remained a staple of Premier League betting culture throughout 2023/24, especially on busy weekends with congested fixture lists. A structured case for profitable accumulator use involved small, consistent stakes on carefully selected legs across different kick‑off times, with the bettor treating each ticket as a low‑risk attempt to enhance returns rather than as the backbone of their strategy. When combined with strict rules against topping up or re‑entering after an early leg failed, this habit could add occasional spikes of profit without threatening the integrity of the core bankroll.

Where many bettors slid into loss, though, was in reacting to near‑misses or early Saturday failures by increasing stake sizes or adding more long‑shot legs on Sunday to “get it back.” Once the emotional desire to recover became the main driver, accas turned from fun side bets into a conduit for compounding errors, especially in a season where shock results were frequent enough to regularly kill even carefully built slips. Over the full campaign, that behaviour produced a pattern of occasional big wins overshadowed by a steady drain, reminding us that most accumulator damage is done not by one ticket but by repeated, emotionally driven escalation.

Comparative view: disciplined versus reactive accumulator use

To make the contrast between these two accumulator paths tangible, it helps to compare them across several dimensions drawn from realistic 2023/24 behaviour on weekends dense with fixtures. In both cases, bettors face the same matches and broadly similar prices, but their internal rules for stake sizing, re‑entry, and emotional control diverge sharply once variance hits.

| Dimension | Disciplined accumulator habit | Reactive accumulator habit |

| Stake per ticket | Small, pre‑defined fraction of bankroll | Varies based on mood and previous results |

| Response to early loss | Stop for the day or switch to singles | Add more legs or increase stakes to recover |

| Role in strategy | Supplement to core value bets | Central method of “making it big” |

| Long-term impact | Occasional boosts without structural damage | Volatile swings with gradual net decline |

The comparison shows that accumulators themselves are not inherently profitable or harmful; the decisive factor is the behavioural framework wrapped around them. When treated as controlled, low‑impact experiments, they can coexist with sound bankroll management, but once they carry emotional weight and recovery expectations, they easily become the main source of long-term loss despite sporadic headline wins.

Case 5: In‑play swings in high‑variance matches

Live betting during 2023/24 often became most intense in fixtures where momentum swung violently, especially in matches involving sides with aggressive attacking styles and vulnerable defences. Consider a game that reaches half-time at 0–0 despite an xG profile suggesting both teams have created several chances, leading to second‑half lines that shorten dramatically on goals as traders and fans anticipate regression. A patient, analytical bettor who recognised that finishing variance alone suppressed the score might take limited, targeted positions on second‑half overs or next‑goal markets, structuring stakes so that a single missed chance would not damage their session.

By contrast, some bettors responded to early misses by repeatedly doubling down in‑play, assuming that “the goals have to come” and compounding their exposure each time odds adjusted to new game states. In matches where late red cards, tactical substitutions, or fatigue shifted the pattern unexpectedly, those layered bets turned a reasonable first decision into an oversized commitment that no longer matched the evolving reality on the pitch. The profitable in‑play case therefore rested on flexible risk control and acceptance that sometimes the game ends 0–0 despite the numbers, while the losing case hinged on the refusal to accept that variance can persist longer than expected.

In some of these complex in‑play situations, certain bettors tried to maintain discipline by routing their live wagers through a structured sports betting service such as ufabet168, where pre‑set limits, market menus, and time‑outs could be used to prevent impulsive overexposure when a match felt more dramatic than the underlying probabilities justified. That approach did not automatically ensure profit, but it changed the shape of potential loss curves by constraining stake sizes and enforcing breaks after rapid sequences of bets, which was particularly relevant during frenetic second halves with multiple goals or controversial decisions. Over the course of a long season, those mechanical safeguards often made the difference between a few controllable bad sessions and an in‑play strategy that gradually consumed the entire bankroll.

Case 6: Emotional overreaction after shock defeats

Shock results such as Fulham’s 3–0 win over Tottenham or Wolves’ upset of Manchester City not only created immediate betting winners and losers; they also shaped behaviour in subsequent rounds. One realistic losing pattern involved a bettor who had backed the defeated favourite heavily, then responded the following week by staking aggressively on the same team to “bounce back,” assuming that better finishing or “anger” would automatically restore normality. When the next fixture brought only a narrow win or another underperformance, that overreaction converted one bad result into a multi‑week downturn driven more by emotion than by rational assessment of fixtures, injuries, and schedule fatigue.

An alternative path, visible among more process‑driven bettors, was to treat the shock loss as a single data point and re‑evaluate whether the team’s long-term metrics still supported their previous rating. If underlying numbers—shot volume, chance creation, defensive structure—remained strong, these bettors either maintained their usual stake sizing or avoided the next match entirely if public reaction had compressed prices too much. In that case, the same headline upset that sent one bettor into a spiral became a useful stress test for the other, clarifying whether their model was genuinely robust or overfitted to short-term form.

Case 7: Cross‑product behaviour and hidden bankroll leakage

During 2023/24, many bettors did not confine their activity to match markets alone; they also engaged with other gambling products, which subtly altered how their football staking behaved. A profitable‑leaning case involved a bettor who ring‑fenced a clear football bankroll and time‑boxed their activity to matchdays, keeping non‑sports wagering separate and ensuring that football results did not dictate their behaviour elsewhere. That separation helped them evaluate football bets on their own merits, with wins and losses feeding back into staking plans without interference from unrelated emotional swings.

In contrast, some bettors flowed between different products during a weekend, allowing frustration or excitement from non‑football activity to influence their Premier League decisions. For instance, after a tense session on a casino online website, a bettor might move immediately into live football markets with heightened risk tolerance, chasing rapid recovery or amplifying a lucky streak without recalculating the underlying probabilities of the match they were entering. Over a full season, this cross‑product leakage often produced surprisingly large football losses that looked, on paper, like bad sports picks but in reality stemmed from emotional carryover and blurred bankroll boundaries.

Summary

Realistic betting cases from the 2023/24 Premier League season show that profit and loss rarely boil down to “good” or “bad” teams; they arise from how specific decisions interact with odds, variance, and bankroll structure over time. Short‑priced favourites, shock upsets, goal totals, accumulators, and in‑play wagers all offered routes to profit for disciplined bettors, yet the same markets punished those who escalated stakes or chased narratives after dramatic results. The most durable lesson from these cases is that success in a high‑scoring, unpredictable season depended less on predicting every twist and more on ensuring that each bet, win or lose, fit into a coherent, repeatable framework.